Table of Contents

Delta

Meaning of Delta

Delta measures the change in Option price for a unit change in the price of underlying. So, if my Delta is 0.46 it shows that for each unit increase in underlying Options price will increase by 0.46 and for each unit decrease in underlying my Options price will decrease by 0.46.

Important Points for Delta

- Delta of Call Option is always positive and Delta of Put Option is always negative

- When you buy Call Option, Delta is positive and when you sell Call Option, Delta is negative.

- When you buy Put Option, Delta is negative and when you sell Put Option, Delta is positive.

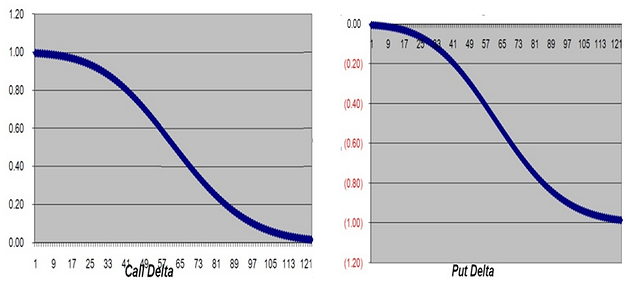

- CallDelta ranges from 0 to 1 and PutDelta ranges from 0 to -1.

- Total of absolute value of CallDelta and PutDelta always comes to 1.

- Delta of Future is always 1.

When you buy Call Option, Positive Delta multiplies by Positive Quantity, hence gives Positive Portfolio Delta. This signifies that buying Call Option means Bullish Position.

When you sell Call Option, Positive Delta multiplies by Negative Quantity, hence gives Negative Portfolio Delta. This signifies that Selling Call Option means Bearish Position.

When you buy Put Option, Negative Delta multiplies by Positive Quantity, hence gives Negative Portfolio Delta. This signifies that buying Put Option means Bearish Position.

When you sell Put Option, Negative Delta multiplies by Negative Quantity, hence gives Positive Portfolio Delta. This signifies that Selling Put Option means Bullish Position.

Delta Graph

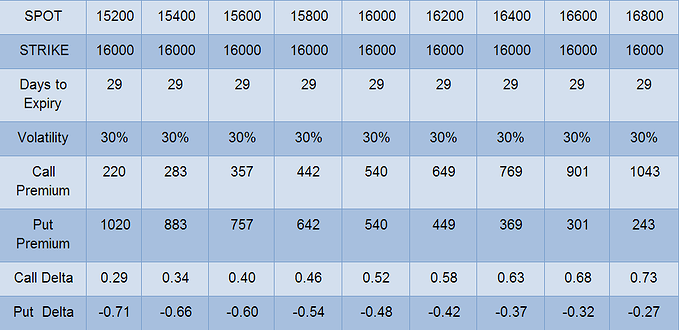

DELTA with respect to change in SPOT PRICE:

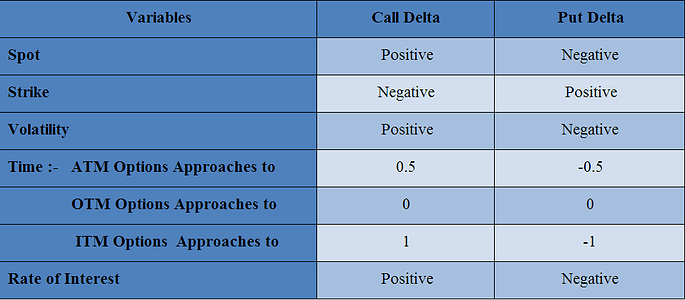

Observations: As spot price increases

- Call premium increases and Put premium decreases.

- CallDelta increases and PutDelta decreases.

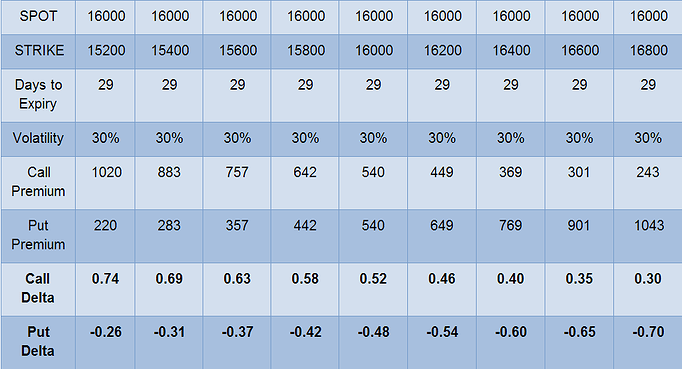

DELTA with respect to change in STRIKE PRICE:

Observations: As Strike price Increases

- Call premium decreases and Put premium increases.

- CallDelta decreases and PutDelta increases.

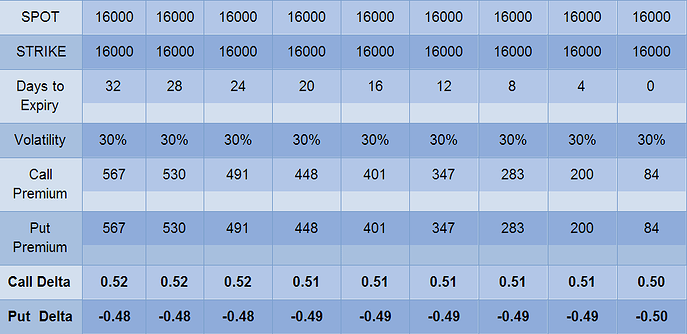

DELTA with respect to change in DAYS TO EXPIRY:

Observations: As days to expiry decreases / time increases

Both Call and Put Premium decrease.

CallDelta decrease and PutDelta increases (Both move towards 0.5).

ATMOptions approaches to 0.5 or -0.5

ITMOptions approaches to 1 or -1

OTMOptions approaches to 0

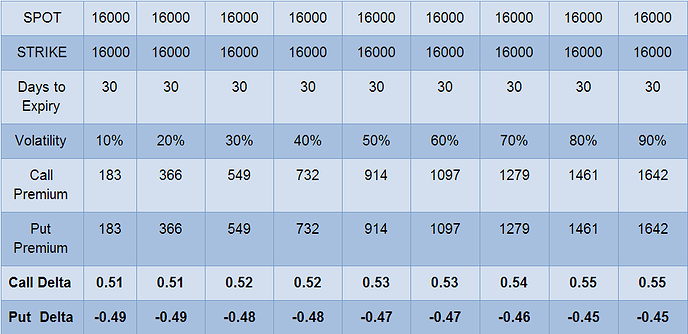

DELTA with respect to change in VOLATILITY

Observations: As Volatility increases

Both Call and Put Premium increases.

CallDelta increases and PutDelta decreases.

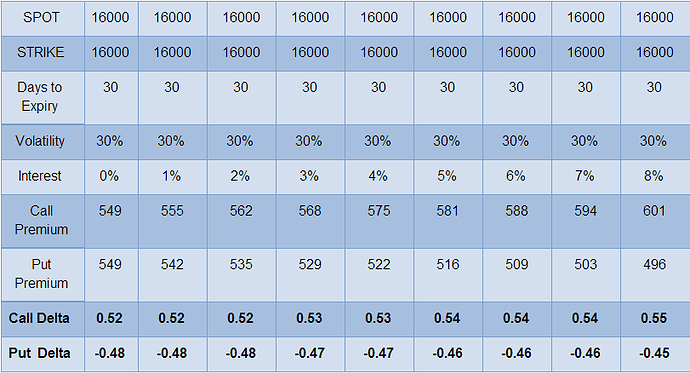

DELTA with respect to change in RATE OF INTEREST:

Observations : As Rate of Interest increases

- Call Premium increases and Put Premium decreases.

- CallDelta increases and PutDelta decreases.